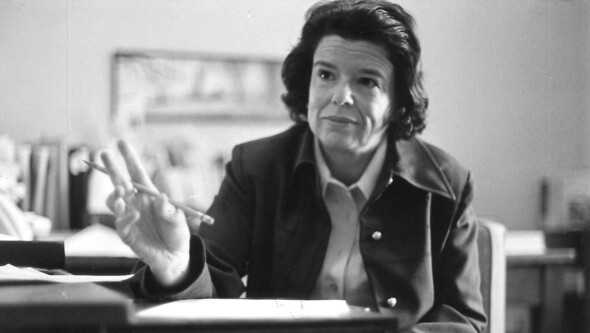

Yale Law School Mourns the Death of Trailblazing Professor Ellen Ash Peters ’54

Chief Justice Ellen Ash Peters ’54, the pioneering lawyer, professor, and jurist, died on April 16 at the age of 94.

Crossing Divides Welcomes Secretary Jeh Johnson and Judge Thomas B. Griffith

The Crossing Divides Program hosted Secretary Jeh Johnson in conversation with Judge Thomas B. Griffith at Yale Law School on April 3.

Clinic Lawsuit Challenges VA Denial of Gender-Affirming Surgery

The Veterans Legal Services Clinic represents the Transgender American Veterans Association in a second federal lawsuit against the U.S. Department of Veterans Affairs, challenging VA’s denial of TAVA’s 2016 rulemaking petition requesting gender-affirming surgery.

“Vital Places”: Yale Law School’s Centers Enhance Intellectual Life

With wide-ranging scholarly work, the Law School's centers make a difference in communities across the country and around the world.

Joint Conference with NYU Law Celebrates Professor Robert Post’s Book on the Taft Court

The Taft Court: Making Law for a Divided Nation, 1921-1930, the latest book by Sterling Professor of Law Robert C. Post ’77, will be the focus of a jointly held conference at NYU Law on April 20.

The Budget Lab at Yale Launches to Provide Novel Analysis for Federal Policy Proposals

The Budget Lab at Yale, a nonpartisan policy research center, launched on April 12 to provide in-depth analysis for federal policy proposals impacting the American economy.

Plights of the Postmodern Era

In his latest book, The Postmodern Predicament: Existential Challenges of the 21st Century, Professor Bruce Ackerman explores the heightened complexities of existentialism brought by the technological era and the impact these have on political alienation today.

Yale Law School Shapes the Future of Artificial Intelligence

Long before ChatGPT became a household name, Yale Law faculty were immersed in learning about legal pathways to regulating AI — as well as the technology’s potential.